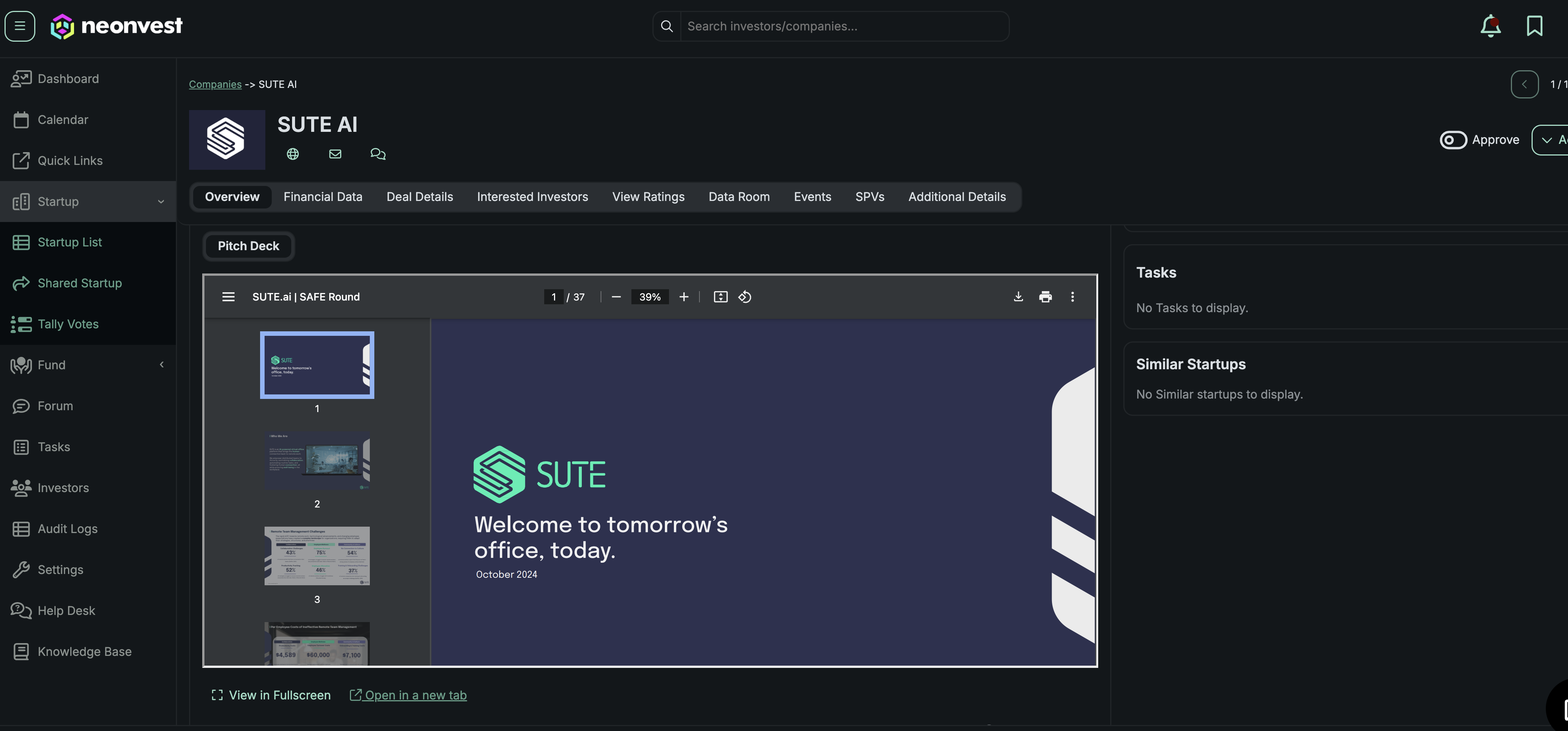

AI-Powered Insights & Expert Evaluation to Build Deal-Ready Startups

-

Supercharger-Led Assessments

Startups undergo a rigorous evaluation by Superchargers—experienced professionals who assess critical aspects such as product-market fit, business model strength, and team capabilities.

-

AI-Driven Gap Analysis

Leverage AI to identify potential weaknesses or areas for improvement in the startup’s strategy, operations, and financials based on the supercharger assessment.

-

Personalized Roadmap

Generate a customized action plan informed by both supercharger feedback and AI insights, offering clear steps to enhance the startup's preparedness for fundraising or partnerships.

-

Tools & Resources

Equip startups with essential tools like financial models, pitch deck templates, and marketing strategies, all tailored to their unique business needs.

-

Supercharger Support

Beyond the assessment, superchargers provide ongoing advisory support, helping startups implement changes and reach key milestones for deal readiness

Core Offerings

Comprehensive review with actionable feedback on structure, storytelling, and design.

In-depth analysis of your startup’s market positioning, financial health, and funding readiness.

End-to-end pitch deck creation or overhaul, tailored to your business and fundraising goals.

Detailed financial models including projections, KPIs, and scenario analysis.

Access to strategic guidance and feedback from N=neonVest’s network of industry experts.

One-on-one consultation to craft a strategic roadmap for your fundraising efforts.

Comprehensive market research and positioning recommendations to differentiate your startup.

Comprehensive market research and positioning recommendations to differentiate your startup.

Creation of investor-ready materials, including one-pagers and executive summaries.

/month

Best for: Companies preparing their story, refining materials, and gaining investor feedback before launching full-scale outreach.

What You Get:

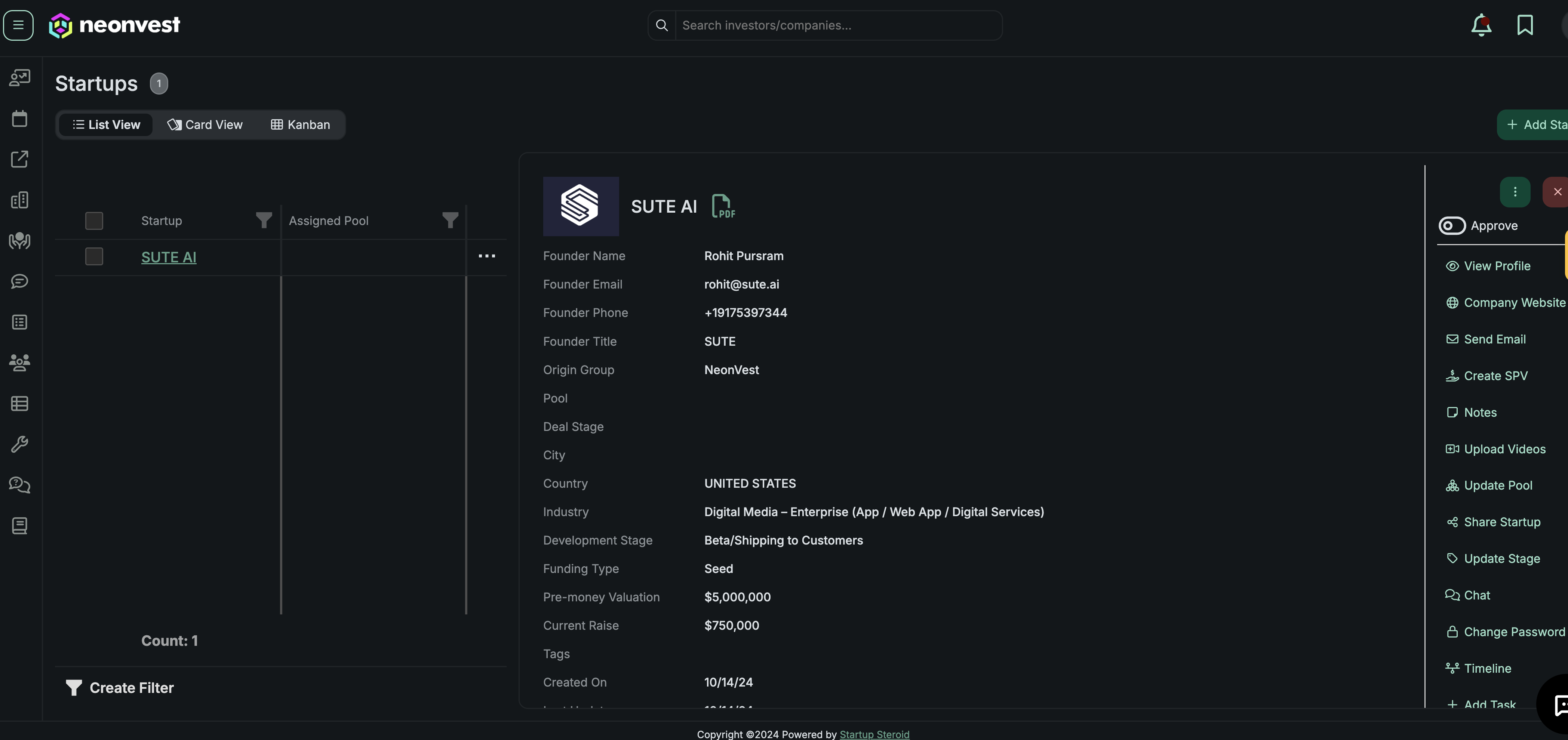

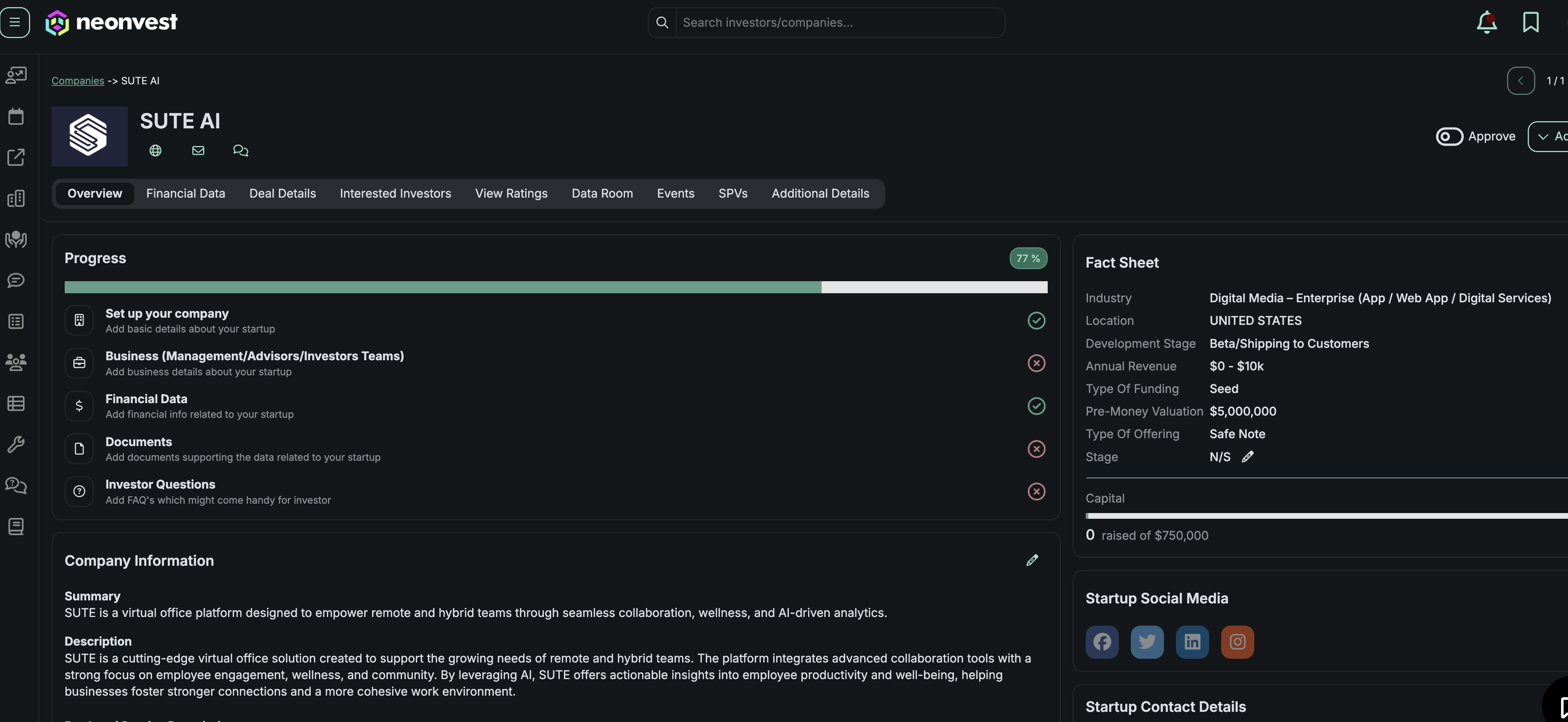

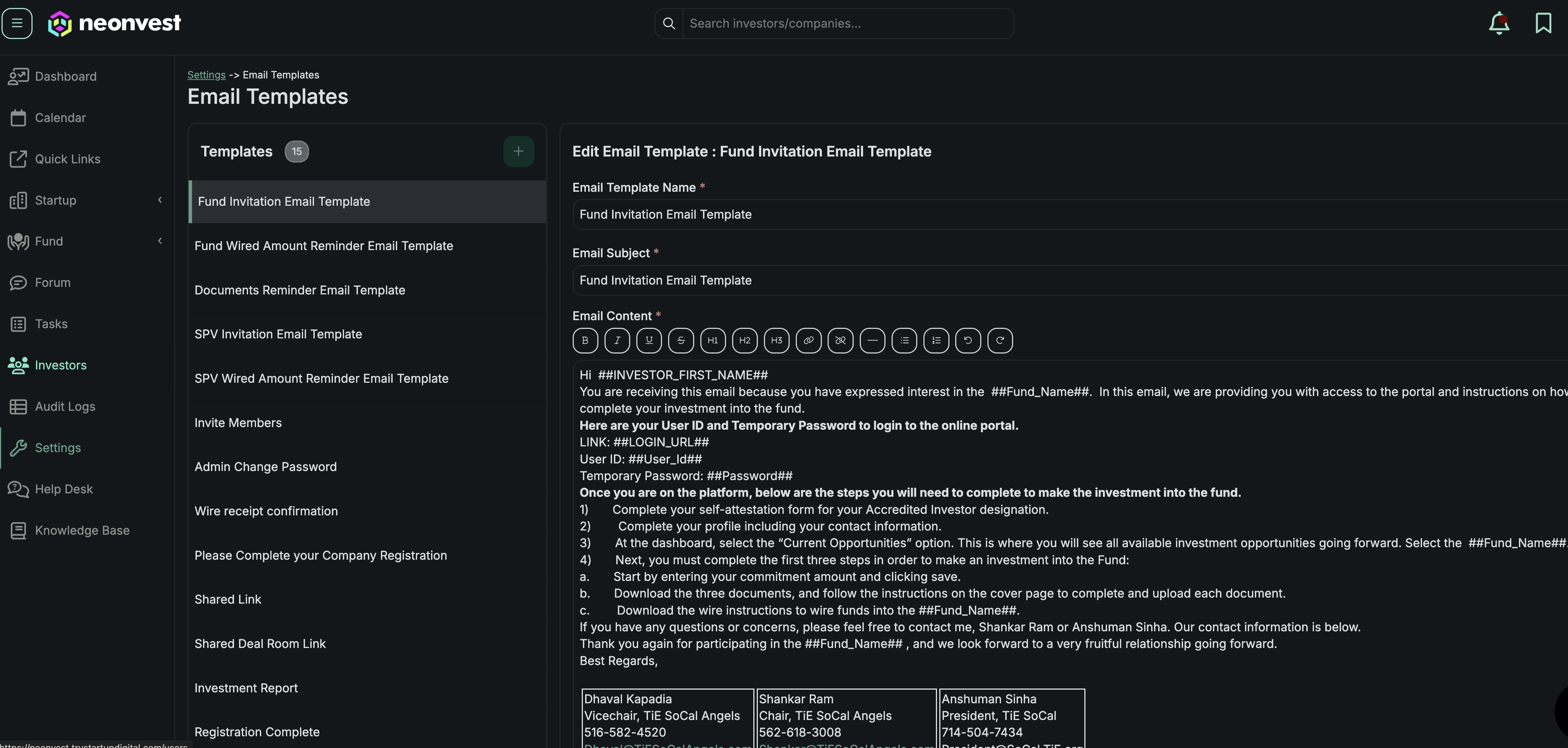

- Listing on the neonVest Deal Platform

- Investor presentation feedback and refinement support

- Detailed Funding Readiness Assessment

- Founder profile in Startup Hub

- Access to investor interest dashboard

- 3 investor calls/month

- Supercharger feedback loop

Why It’s Attractive:

Designed for founders moving fast. This package delivers high-signal outreach, early validation, and warm investor conversations — powered by AI and paired with strategic materials to build momentum.

Best for: Companies raising <$2M or testing market appetite before a larger round.

What You Get:

- AI-enriched 3-step email campaigns targeting 500–1,000 U.S. investors

- LinkedIn outreach (1 account) to complement email flow

- Foundational investor assets: Investor Q&A, Tear Sheet, Founder Video

- Listing on the Deal Platform + exposure in the Startup Hub

- Investor tracking dashboard and light CRM access

- Estimated 3–4 warm investor calls/month

- Funding Strategy & Target Investor List

- Supercharger feedback loop

Why It’s Attractive:

The Blitz plan is the global sweet spot for high-conviction engagement. Structured outreach meets premium storytelling and active feedback loops — ideal for multi-sector or international raises.

/month

Best for: Companies raising $2M–$10M with global ambitions and a need for strategic storytelling and high-volume outreach.

What You Get:

- Personalized 7-step email nurturing with segmentation, scoring, and AI-optimized routing

- LinkedIn outreach via 2 accounts + real-time campaign adjustments

- Nova Hot List: curated, high-fit investor outreach with personalized outreach via email, linkedin and phone calls

- Advanced investor materials: Fireside Chat script, Deck + Term Sheet review, Branded One-Pagers

- Brand amplification: Solo newsletter feature + multi-channel LinkedIn optimization (4–5 accounts)

- Unlimited campaign iterations + dedicated account manager

- Estimated 6+ warm investor calls/month

Raise like a pro. The Boom plan is built for full-spectrum execution — with concierge support, investor concierge funneling, brand authority, and continuous iteration until capital is secured.

Dan Ciporin

Lylan Masterman

Paul Weinstein

Andrew Romans

Stefanie Wojciech

Phil Nadel

Aakash Jain

Abhay Jain

Danni Xie

Jeffrey M. Zucker

Henry Wong

Stephen Shapiro

Ryan Spitler

Hongkai He

Tobias Bauer

Taylor Chapman

Martin Strommer

Chris Graham

Dan Ciporin

Sector focuses include AdTech, Agriculture, AI, AR/VR, Blockchain, ClimateTech, Consumer Tech/Retail, Cybersecurity, FinTech, FoodTech, Healthcare, IoT, Mobility, PropTech, Robotics, SpaceTech, and more. Stage focuses: Pre-seed to Series B, primarily in the USA, Canada, and Europe. Expertise spans financial modeling, pricing, SaaS metrics, startup valuation, term sheets, board formation, exit prep, pitch coaching, market sizing, fundraising, talent hiring, and strategy across B2B and B2C models.

Lylan Masterman

Sector focuses include AdTech, Agriculture, AI, AR/VR, Blockchain, ClimateTech, Consumer Tech/Retail, Cybersecurity, FinTech, FoodTech, Healthcare, IoT, Mobility, PropTech, Robotics, SpaceTech, and more. Stage focuses: Pre-seed to Series B, primarily in the USA, Canada, and Europe. Expertise spans financial modeling, pricing, SaaS metrics, startup valuation, term sheets, board formation, exit prep, pitch coaching, market sizing, fundraising, talent hiring, and strategy across B2B and B2C models.

Paul Weinstein

Paul Weinstein is a founding General Partner at Azure Capital Partners with over 28 years of investment experience in technology. He focuses on sectors like AgTech, AI, AR/VR, Blockchain, Cybersecurity, FinTech, and more. Paul invests in Pre-seed, Seed, and Series A stages, primarily in the USA and Canada. His expertise includes strategy, fundraising, market sizing, business models, operational support, and pitch coaching, with a focus on B2B, B2C, B2B2C, and D2C business models.

Andrew Romans

Andrew Romans, General Partner at 7BC Venture Capital, is a top-performing VC, entrepreneur, and 3-time author. He’s raised hundreds of millions in funding, leading startups to IPOs and M&A exits. Fluent in English, French, and German, with an MBA from Georgetown, he advises corporations and governments on VC policies. Romans focuses on sectors like FinTech, AI, and ClimateTech, investing from pre-seed to Series C, with expertise in fundraising, valuation, growth, and exit strategies.

Stefanie Wojciech

LBBW Venture Capital invests in technology-driven companies across life sciences, healthcare, fintech, and digital transformation, focusing on late seed and Series A rounds. Stefanie holds a PhD in Molecular Biology/Biochemistry with a specialization in molecular medicine. She has extensive experience in biomedical innovation in both academia (project management, technology transfer, public-private partnerships) and industry (business development, venture capital, and non-dilutive funding). Her sector focus includes healthcare (digital health, pharma, medical devices) with a geographic focus on Europe, and she specializes in seed and Series A stage investments.

Phil Nadel

Phil is Co-Founder and Managing Director at Forefront Venture Partners. A serial entrepreneur and angel investor, he has founded and exited multiple startups. His focus spans TravelTech, Water, Sustainability, SportsTech, Supply Chain, SpaceTech, Social Networks, Robotics, PropTech, Mobility, Media, and more. He specializes in Seed and Series A stages, with expertise in exit preparation, human capital management, board formation, SaaS metrics, startup valuation, financial modeling, pitch coaching, and growth strategy. He focuses on the USA and Canada.

Aakash Jain

Associate Partner at VU Venture Partners, investing early in exceptional founders who aim to transform industries with innovative solutions. Focuses include AdTech, AI, AR/VR, Blockchain, Cannabis, ClimateTech, Cybersecurity, DeepTech, Education, FinTech, Healthcare, IoT, Marketplace, Media, PropTech, Robotics, and more. Specializes in Pre-seed to Series B stages across global markets, including the USA, Canada, Latin America, Europe, Africa, and Asia. Expertise covers financial modeling, SaaS metrics, startup valuation, pitch coaching, and market strategy.

Abhay Jain

Focuses on AdTech, AI, AR/VR, Consumer, FinTech, Gaming, Media, SportsTech, Cannabis, and Education. Invests at Pre-seed to Series A stages, primarily in the USA. Specializes in B2C, B2B2C, and D2C models. Expertise includes COVID-19 market dynamics, strategy, market sizing, fundraising, operational assistance, pitch coaching, business model development, and ideation.

Danni Xie

Specializes in AdTech, AI, AR/VR, Consumer, FinTech, Gaming, Media, SportsTech, Cannabis, and Education. Invests at Pre-seed to Series A stages in the USA. Focuses on B2C, B2B2C, and D2C models. Expertise includes COVID-19 market dynamics, strategy, market sizing, fundraising, operational assistance, pitch coaching, business model development, and ideation.

Jeffrey M. Zucker

Jeffrey M. Zucker

Jeffrey M. Zucker is a serial entrepreneur with a diverse background in real estate, hospitality, entertainment, design, and cannabis. As President of Green Lion Partners, he oversees all company activities. A Boston University graduate, Jeffrey founded Saltshaker Holdings, managing real estate and angel investments. He also launched Big Smits Entertainment and Two Bridges Design. An activist, he is Vice Chair of the Marijuana Policy Project and a trustee of Students for Sensible Drug Policy. His focus includes sustainability, media, healthcare, and cannabis, with expertise in sales, marketing, growth, and strategy.

Henry Wong

Professor Henry Wong is a venture investor, serial entrepreneur, and Stanford mentor with 35 years in Silicon Valley. He founded and exited five successful startups, including SS8 Networks, IP Communications, XaQti Semiconductor, CNet Technology, and Combinet, which was sold to Cisco for $165M. He is now a Partner at Pegasus Tech Ventures. His focus includes Supply Chain, Sustainability, SportsTech, Social Networks, and more, with expertise in B2B models, human capital, exit preparation, and strategy.

Stephen Shapiro

Strategic leader adept at forging partnerships and driving ecosystem growth for portfolio companies. Known for surpassing goals through strategic planning and start-up initiatives, with a strong track record in joint ventures and market penetration. Proficient in digital health, computer services, and cellular industries. Currently a partner at eHealth Ventures, an Israeli venture fund specializing in Digital Health, with 15 portfolio companies and over 1,400 reviewed. Focuses on Pre-seed to Seed stages in the USA, Canada, and the Middle East. Expertise includes board formation, pitch coaching, and operational assistance.

Ryan Spitler

Boutique Venture Partners is an impact fund investing in innovative companies focused on disease prevention, early detection, and treatment in biotech, digital health, medtech, and health edtech. We support early-stage firms with novel approaches, strong IP, and significant growth potential. Leveraging connections with top health ecosystems, we access innovations from leading academic institutions and entrepreneurs. Our team of scientists and business leaders collaborates closely with portfolio companies to advance transformative technologies.

Hongkai He

Hongkai He is a Founding Partner at Taihill Venture, a Boston-based VC focusing on disruptive technology at the pre-seed and seed stages. Since 2017, Taihill has invested in over 80 U.S. companies, including Xtalpi, Relativity, and Lightelligence. Hongkai is also VP of the U.S.-China Health Summit, promoting global health through cross-country knowledge exchange. Previously, he co-founded Boston Innovation Growth, connecting 300+ U.S. startups to Chinese investors, and founded Talent Jungle. He holds advanced degrees in Management Science and Computational Mathematics.

Tobias Bauer

Tobias Bauer is the Principal at Blockchain Founders Fund, investing in and building top-tier startups. He mentors for 500 Startups, APX, PlugAndPlay, NUMA New York, and Alchemist Accelerator, and is a Venture Partner at Republic. Tobias previously worked with Chinaccelerator and co-organized a major career fair in Thailand. He has lived in 9 countries, is fluent in Mandarin, English, and German, and holds advanced degrees from National University of Singapore, Tsinghua University, and Management Center Innsbruck.

Taylor Chapman

Focused on Education, Future of Work/Productivity, and Impact, with investments at Seed and Series A stages in the USA. Expertise includes SaaS metrics, sales/marketing/growth/customer acquisition, fundraising, and strategy. Experience spans B2B, B2C, B2B2C, and D2C business models.

Martin Strommer

Focused on sectors like AdTech, AI, Blockchain, Cannabis, ClimateTech, FinTech, Healthcare, and more. Invests at Seed and Series A stages in India and Southeast Asia. Expertise includes strategy, market sizing, fundraising, sales/marketing/growth, operational assistance, pitch coaching, financial modeling, technology, and startup valuation. Proficient in B2B and B2B2C business models.

Chris Graham

Chris is the Managing Director and Founding Partner of NoName Ventures, focusing on seed-stage Enterprise SaaS investments in the USA. Expertise includes operational assistance, sales/marketing/growth, fundraising, market sizing, strategy, pitch coaching, and ideation. NoName Ventures primarily invests in B2B business models.

AI-powered investor matching

Get intelligently matched with the most relevant investors in our Supercharger Network

Enhanced pitch videos

Personalized feedback

AI-powered courses

-

Rating Thresholds

Startups that meet the required neonVest rating thresholds—4.0 for earlier-stage companies and 4.5 for later-stage companies—qualify for enhanced investor exposure.

-

Strategic Marketing

Gain access to neonVest’s extensive investor network through targeted marketing campaigns, designed to attract interest from the right investors at the right time.

-

Optional Representation by Pillai Capital

Opt to be represented by Pillai Capital, neonVest’s trusted investment banking partner, to maximize your fundraising potential with tailored advisory and support.

-

Success Fee

A success fee of up to 6% is applied, based on the size of the funding round for successful financing secured through neonVest.

Fundraising Simplified

Leverage neonVest’s Deal Execution Platform to streamline every aspect of the fundraising process.

AI-Driven Matching

Document Management

Our Partnership with Pillai Capital

Our Partnership with Pillai Capital