At neonVest, our mission is to bridge the gap between visionary founders and forward-thinking investors through cutting-edge AI technology. Born from the fusion of neonVest and SaaS Turbo, our platform redefines the landscape of startup-investor connections.

neonVest Network

Assessment

neonVest operates by first assessing start-ups through our Supercharger Network, where top investors and experts provide ratings and feedback on the startups’ potential.

Development

Startups that need further development receive strategic support to help them become investor-ready.

Onboarding

Alignment

We take a success fee only when a funding deal is closed, ensuring our interests are fully aligned with the success of the startups we support.

neonVest Network

70,000

founders

60,000

investors

600

- Innovation: We continually evolve our technology and strategies to stay ahead in the startup and investment landscape.

- Integrity: Transparency and trust are at the core of every partnership we build.

- Collaboration: We connect founders with investors and experts to create a supportive, success-driven ecosystem.

- Growth: We focus on driving growth for startups and investors, providing the tools and insights to turn potential into performance.

- Tailored Solutions: Our platform offers personalized support for the unique needs of startups and investors, ensuring effective connections.

- Data-Driven Insights: We use AI to provide actionable insights that improve decision-making and optimize investments.

- Exclusive Network: Our Supercharger network gives access to top industry leaders and investors, setting us apart.

- Comprehensive Support: We offer full-spectrum services, from matching to strategic guidance, to ensure long-term success for all partnerships.

neonVest is the product of the strategic merger of a venture-backed SaaS-based startup-investor network and SaaS Turbo, an AI-powered founder support system. This union brings together cutting-edge AI technology and deep investor expertise to create a powerful eco-system. With a network of over 1,000 top investors, including industry leaders like Bessemer, Azure, and DCVC, neonVest connects more than 44,000 founders with tailored investment opportunities. Our platform streamlines the fundraising process, giving investors access to high-potential startups while empowering founders to succeed.

neonVest was founded by three accomplished entrepreneurs with successful exits under their belts, each bringing a deep understanding of the fundraising landscape and what it takes to position a company for sustainable growth. Our team, composed of experts in AI, business development, and startup growth, is dedicated to providing tailored investment opportunities and guiding startups through every stage of their journey to success.

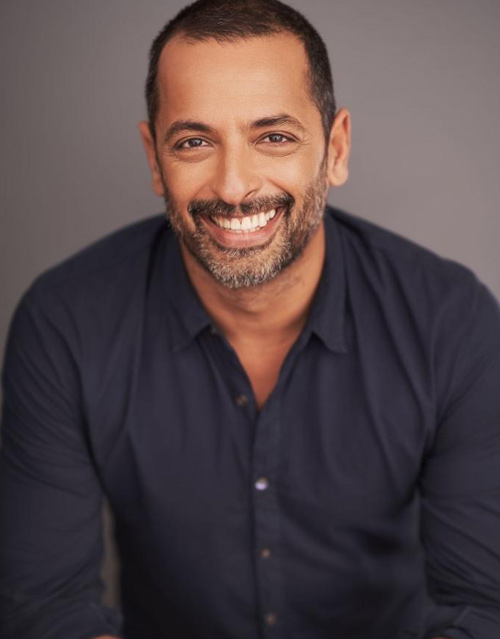

Rohit C. Pursram is a distinguished CEO, entrepreneur, investor, and advisor with extensive success in SaaS and digital media. His expertise spans operations, finance, strategy, product development, and innovation, driving success for both startups and Fortune 500 companies. Rohit’s impressive career includes being part of the founding team at Time Digital, leading strategic planning and digital for McGraw-Hill’s $1 billion B2B business, and executing over $20 billion in technology acquisitions at Evercore Partners and Lehman Brothers. He founded and sold Ready2Ride, a leading digital marketing software solution in the powersports industry, known for its innovative use of technology and data. Rohit is also founder of SUTE, an intelligent virtual office for remote teams with a focus on employee wellness and culture, and KIKI an AI-driven dating app that looks to re-invent dating as a smart journey of self-discovery. His ventures are characterized by smart application of technology, data, and AI. Additionally, Rohit serves as an advisor and Board member for various startups in SaaS, AI, blockchain, and metaverse categories.

Educated at Harvard Business School (MBA, Timken International Fellow) and Wesleyan University (BA with High Distinction, Davenport Scholar), Rohit brings a strong academic background to his professional endeavors. Outside work, he is passionate about heli-skiing, travel, wine, painting, triathlons, and Crossfit. Rohit is also a founding member of Lincoln Center’s Young Patrons Society.

Aakash is an experienced entrepreneur, operator and investor. He is the co-founder of neonVest, a VC-backed SaaS startup that he founded in 2018, where he headed up product, technology, finance and fundraising. neonVest was successfully acquired by AI Turbo in 2024. The company is a leading technology startup connecting early-stage founders to top-tier VCs globally via 1-on-1 video chats for fundraising, networking and strategic advice.

He is also a Partner at Peak Sustainability Ventures, one of India’s leading climate VC funds, and is a domain expert in energy, food systems, water and climate investing. Aakash has several years of VC experience from Accion Venture Lab, an emerging markets-focused fintech VC fund based in Washington D.C., Sattva Capital, a private investment office based in Mumbai, and Contrarian Partners, a generalist tech fund based in Mumbai. Aakash began his career on the investments side at Aksia, a hedge fund advisory firm based in New York.

Aakash is actively involved in the global tech startup and VC ecosystem. He is a TEDx speaker, where he has given a talk on “The Hidden Cost of Everything We Do”. He is also the Co-President of Bleeker Street Angel Group, an India-focused angel network for NYU Alumni.

Aakash holds a B.Sc. in Finance and International Business from NYU Stern School of Business.

Surya is a seasoned C-Suite leader, entrepreneur, builder, and operator. He is a successful exited founder of a VC-backed SaaS startup, neonVest, that was acquired in 2024 by AI Turbo, an AI-enabled EdTech company selling e-learning courses, custom publishing, and media network offerings to founders and entrepreneurs globally. neonVest is a leading venture-backed global startup network that gives founders on-demand access to top-tier VCs & operators through 1-on-1 video conversations for fundraising, networking and strategic advice, via a data-driven matchmaking platform.

Previously Surya worked at DiligenceVault, a Goldman-Sachs backed FinTech company, that provides a data-driven due diligence platform for asset allocators and streamlines investor engagement for asset managers. At DiligenceVault, Surya focused on Business Development, Growth, & Product. Prior to that he worked at Aksia in investment research focusing on hedge fund and private credit strategies. Surya graduated from Columbia University with a BS in Operations Research – Engineering Management Systems.